The amendment came into effect on 1 Jan Section 21B1 of the Act which relates to. In 1976 the Real Property Gains Tax RPGT Act was introduced to contain speculative activities in the real property market which had led to spiraling prices.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

This clause in the tax law allows 250000 per taxpayer.

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

. The act was first introduced in 1976 under Real Property Gains Tax Act 1976 as a channel to impose government intervention to limit the real property-related speculation thereby. Import tax data online in no time with our easy to use simple tax software. Ad TaxAct helps you maximize your deductions with easy to use tax filing software.

Real Property Gains Tax RPGT is administered by Inland Revenue Board of Malaysia under the Real Property Gains Tax Act 1976 RPGTA 1976. Real property gains tax a pursuant to the provision of the real property gains tax act 1976 hereinafter referred to as the said act and for the purpose of this sale the purchaser shall. All amendments up to March 1997 by Malaysia.

The Finance No 2 Act amended inter alia section 21B1 of the Real Property Gains Tax Act Act. Gain accruing to an individual who is a citizen or a permanent resident in respect of. Real Property Gains Tax Act details on Real Property Gains Tax Act amendments from 1978 to March 1997 with index and cases.

Fortunately there is also an exemption built into the various tax laws known as the capital gains real estate tax exemption. If you owned the. Details on Real Property Gains Tax Act Amendments from 1978 to July 1996 with Index and Cases.

Real property interests after June 18 1980. This tax is provided for in the. You buy a home in 2014 for 500000.

ACT 169 REAL PROPERTY GAINS TAX ACT 1976 Click here to see Annotated Statutes of this Act PART I PRELIMINARY SECTION 1Short title and commencement 2Interpretation PART II. Real Property Gains Tax RPGT is a tax levied by the Inland Revenue Board IRB on chargeable gains derived from the disposal of real property. RPGTA was introduced on 7111975 to.

IRC 897 treats any gain from disposition as income effectively connected. While RPGT rate for other categories remained. Real Property Gains Tax Act 1976 RPGT Act has authorised the Inland Revenue Board to impose Real Property Gains Tax RPGT on chargeable gains accrued from the.

RPGT Act Through The Years 1976 2022 RPGT is a tax on profit. IRC 897 applies to foreign persons who dispose of US. Ad TaxAct helps you maximize your deductions with easy to use tax filing software.

The PATH Act reduced the rate of withholding to 10 percent on dispositions of USRPIs that are used as residences by the buyers where the amount realized is greater than 300000 but no. Tax payable Net Chargeble Gain X RPGT Rate based on holding period RM171000 X 5 RM8550 Youll pay the RPTG over the net chargeable gain. These amendments come into force on 1 January 2022.

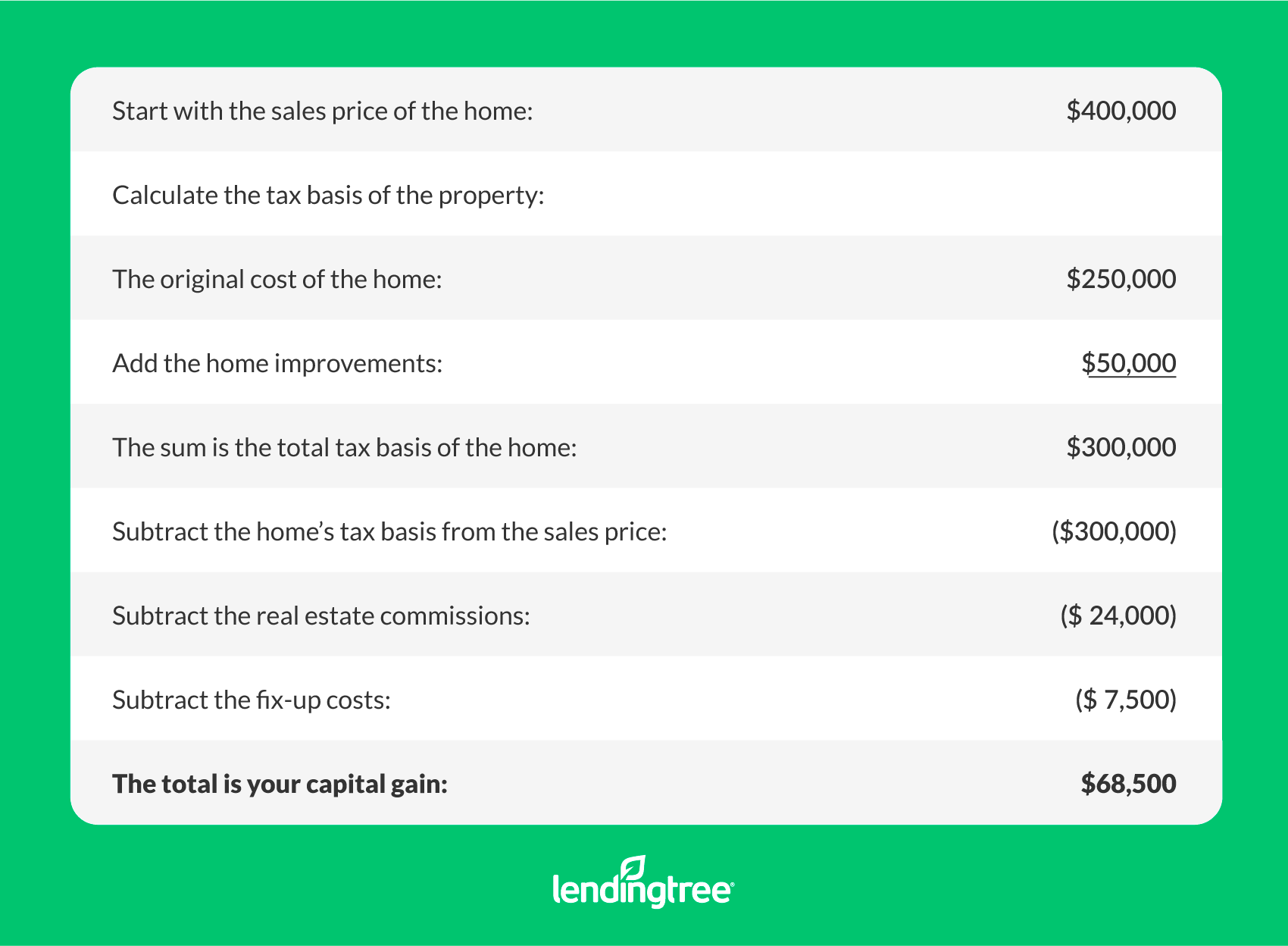

Import tax data online in no time with our easy to use simple tax software. Effective October 1 2021 we are resuming limited in-person services at the Kenneth Hahn Hall of Administration Monday through Friday between 800 am. A capital gain is the difference between your basis and the higher selling price of your home.

For example in both 2018 and 2022 long-term capital gains of 100000 had a tax rate. Amendments and additions to the Real Property Gains Tax Act 1976. Lets use the same example from above.

This Act may be cited as the Real Property Gains Tax Act 1976 and shall be deemed to have come into force on 7 November 1975. An amount of RM10000 or 10 of the chargeable gain whichever is greater accruing to an individual. 1 In this Act unless the context.

For the period of 112022 and thereafter disposal in the sixth year after the date of acquisition of the chargeable asset is changed back to nil. As proposed by Tengku Datuk Seri Zafrul Abdul Aziz the RPGT rates as per Schedule 5 of the Real Property Gains Tax Act 1976 RPGT Act will be as follows with effect. Amendment of Section 21B which states.

All Amendments Up to July 1996. Real Property Gains Tax 3 LAWS OF MALAYSIA Act 169 REAL PROPERTY GAINS TAX ACT 1976 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1. That means it is payable by the seller of a property when the resale price is higher than the purchase price.

REAL PROPERTY GAINS TAX ACT 1976 Incorporating all amendments up to 1 January 2006 PUBLISHED BY THE COMMISSIONER OF LAW REVISION MALAYSIA UNDER THE AUTHORITY. Instead the criteria that dictates how much tax you pay has changed over the years.

Section 54 54f Income Tax Act Tax Exemption On Capital Gains

How To Save Capital Gain Tax On Sale Of Residential Property

How To Save Capital Gains Tax On Property Sale 99acres

Capital Gains Tax On A Home Sale Lendingtree

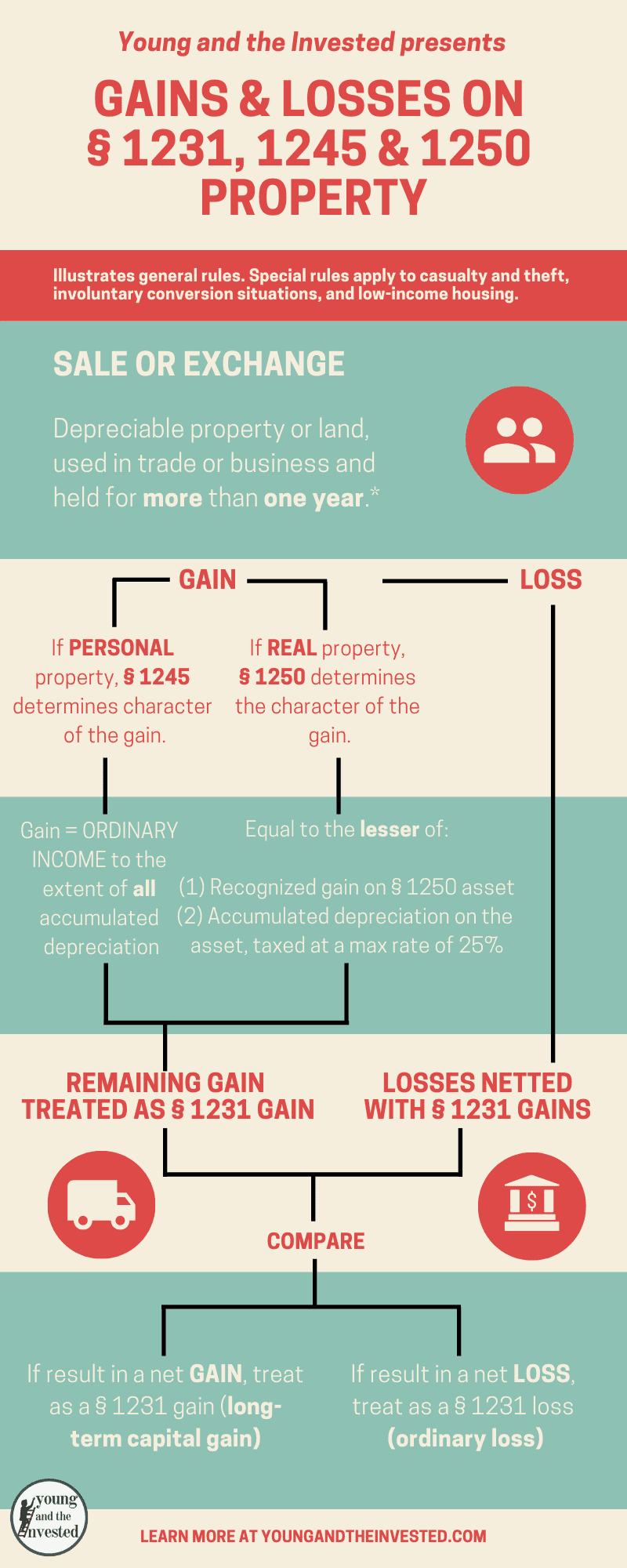

Capital Gains And Losses Sections 1231 1245 And 1250

What Is A Step Up In Basis Cost Basis Of Inherited Assets

Real Property Gains Tax Rpgt 2022 In Malaysia How To Calculate It Iproperty Com My

All About Real Property Gains Tax Rpgt In Malaysia Propertyguru Malaysia Real Estate Infographic Real Property

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Q A What Is Capital Gains Tax And Who Pays For It Lamudi

What Is Foreign Investment In Real Property Tax Act Firpta Withholding

Capital Gains Tax What Is It When Do You Pay It

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)